|

Happy Sunday!

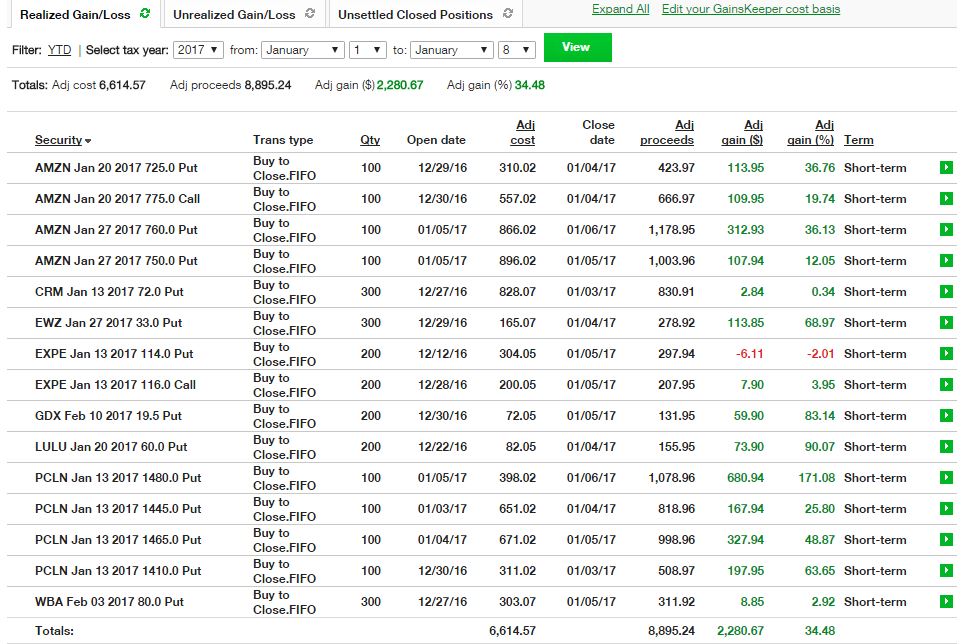

2016 was a transition year for me as I took a new job and relocated my family to the Seattle area toward the end of the year. I've no access to my mobile phone and little to no internet access in my prior job. To continue engaging in my trades, I rely on commodity oil future contracts which are traded almost 24 hours a day starting on Sunday evening at 6pm Eastern Standard time. This has allowed me to engage in my trading strategy. This is not always optimal as the trading volume tends to be light outside of the main trading hours with the bid-ask spreads being wide. To place my trades, I always use limit orders and sometimes they don't get fill. This is also true for my limit orders in regular security underlying contracts. As such, I did not place a lot of trades in 2016. I look forward to placing a lot more trades this year. My trading continues to be somewhat light as we're at market highs. At the moment, my overall position is delta short as beta weighted against the S&P 500 Index (SPY). I'll patiently wait for opportunities to present itself before scaling into my trades. By opportunities, I'm referring to panic or market uncertainty that will drive higher volatility and thus richer premium contracts. If you can stomach volatility, which is a mean reverting process, you can make money. Here is a snapshot of my closed positions after the first week of 2017. Note that 100 shares is equivalent to one contract. Most of these positions were placed toward the end of last year, see Open Date column below. This is to illustrate my favorite part of the strategy and that is to take profit and take is often. Some of the positions such as CRM, EXPE, and WBA were in the red since I entered these trades and when they eventually breakevens or made a tiny profit, my limit orders to close got filled. I'm currently going over my trading strategy with a good friend and co-worker, Chi. He is currently applying this strategy on his retirement accounts via covered calls to start.

1 Comment

|

Welcome!High probability option trading with Mr. 848Days! Archives

March 2017

|

- David's Memoirs

-

Portuguese

- PREFÁCIO por Russell Dorn

- CAPÍTULO 1: INTRODUÇÃO

- CAPÍTULO 2: ÁRVORE GENEALÓGICA

- CAPÍTULO 3: A ASCENSÃO DO KHMER VERMELHO

- CAPÍTULO 4: SOBREVIVENDO AO GENOCIDIO CAMBOJANO

- CAPÍTULO 5: UMA LONGA JORNADA PARA A AMERICA

- CAPÍTULO 6: ASSENTAMENTO E DE INTEGRAÇÃO NA SOCIEDADE

- CAPÍTULO 7: CARREIRA PROFISSIONAL

- CAPÍTULO 8: VIAGENS E AVENTURA

- CAPÍTULO 9: FAMILIA, BRASIL, PAIXÃO

- CAPÍTULO 10: O SONHO AMERICANO

- Contact

RSS Feed

RSS Feed