|

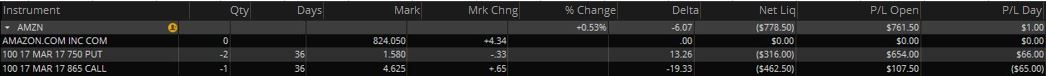

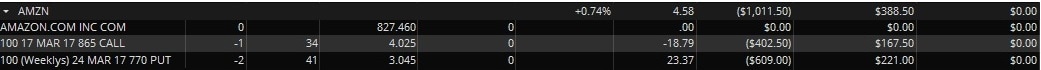

Look at the charts of the SPY and its implied volatility below. It's a really good feeling to see we're at an all time high and volatility continue to creep lower, the bottom graph. Similarly, my net liq hits an all time high this week as well. With that in mind, I continue to take smaller profit by closing on the following positions this week: FB (traded a couple of time this week), KORS (day trade), /CL (oil futures), AMZN and GOOGL (on both positions, I rolled up the long or put leg) and added new positions: GILD, TEVA (sell a couple of contract as it dropped 6% and earning is next week), GPRO, TWTR (after dropping for a couple days after earning), and BMY. Example on AMZN, rolling up the "put" contracts higher and further out to get delta positive. AMZN has been creeping up since its earning drop last week and a stock I love trading, mostly on the long side for the past couple of years. This along with GOOGL helped to buffer my short delta on SPY and VXX. In the pictures below, I rolled up the 750 put position to 770 put position with longer duration.

0 Comments

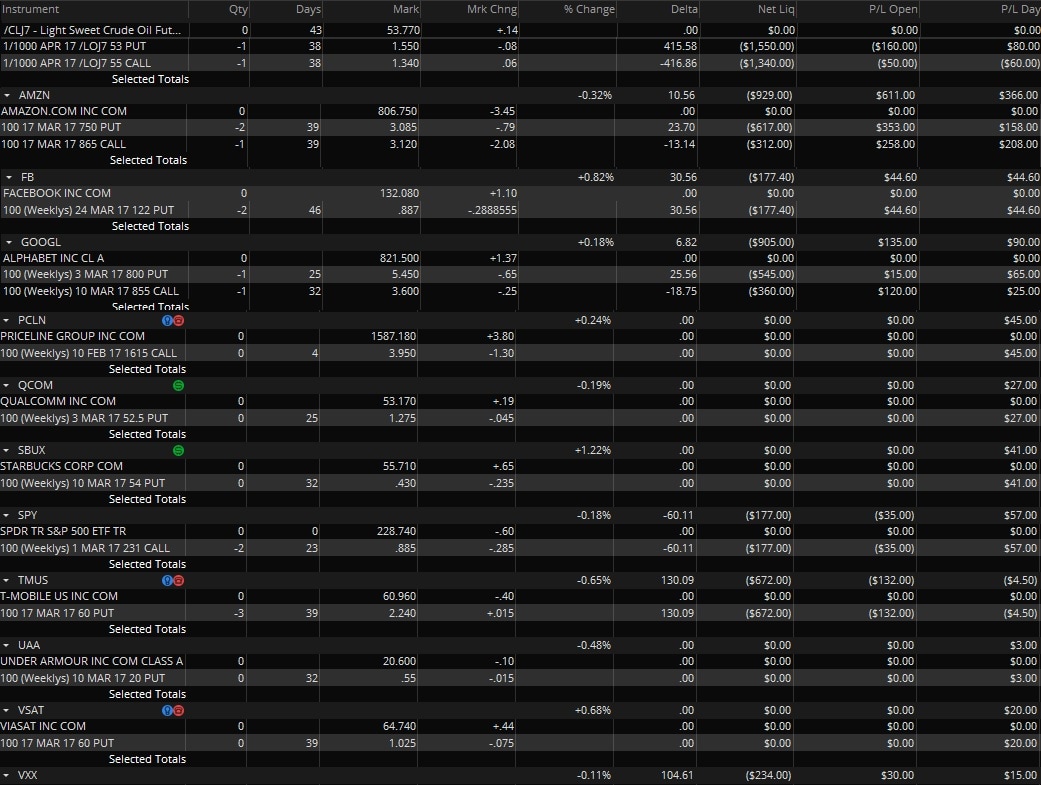

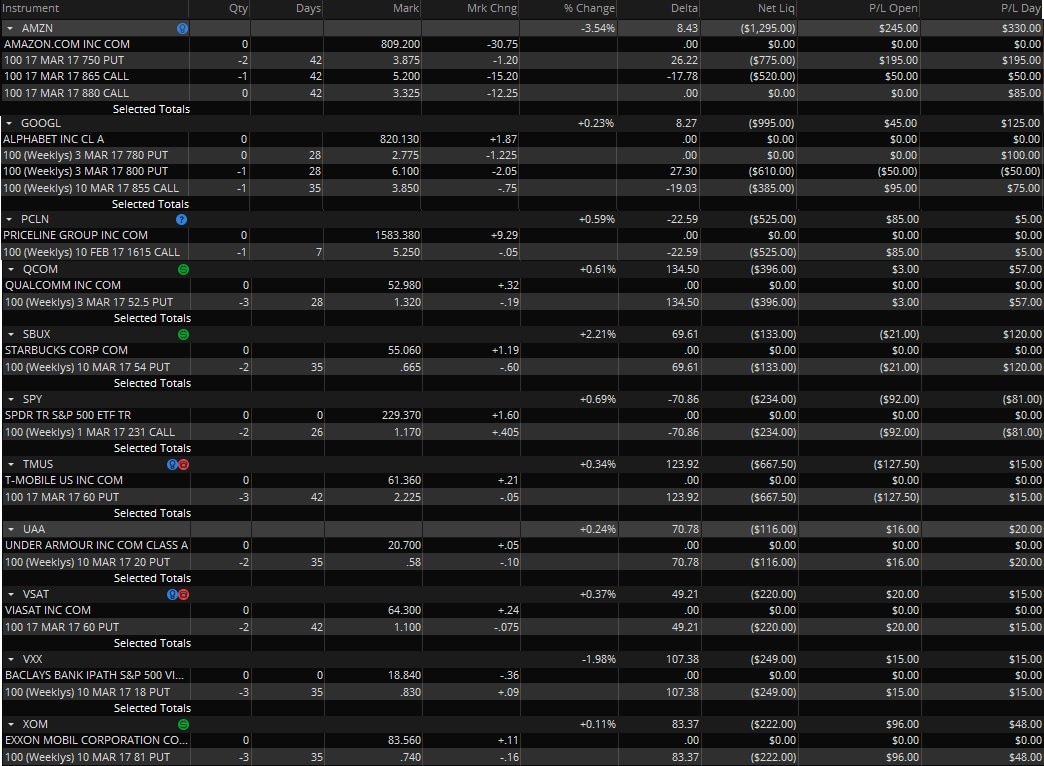

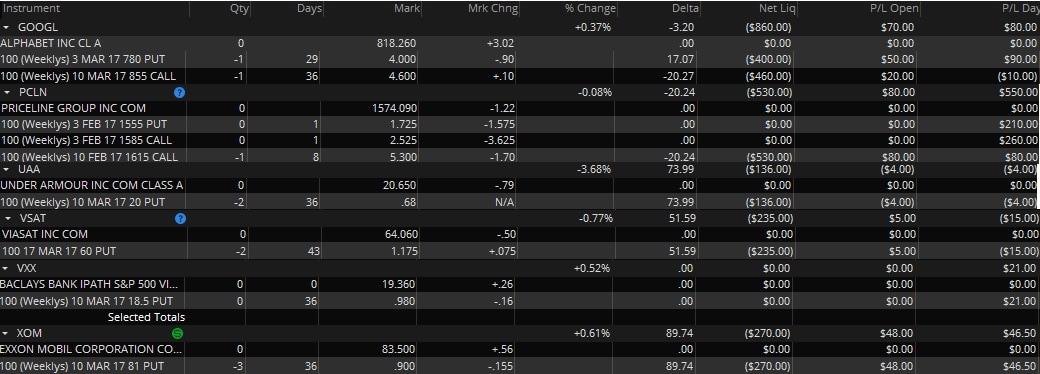

Happy Monday! As the market dropped around 0.8% this morning, my overall position delta is now positive which means I'm long the market. By market, I'm referring to the SPY which is what I use to beta weight my positions. At the moment, I'm cautious as we're at market highs so I took the opportunity to close a number of positions for a profit to bring my overall delta toward neutral. With that said, I closed out of QCOM, PCLN, SBUX, UAA, and VSAT. I tend to close my position sooner rather than later for smaller profit in this caution environment. I've been wanting to get back into FB and today I added a position in Facebook. Previously, I was delta short oil futures and it dropped about $0.80 today and now I'm delta neutral in oil futures, exactly where I wanted. It is trading up a bit in after hours. I'll look to add long positions in oil future in the coming days. The other position I missed in my cut and paste is XOM which is still a position I've at the moment. As you can see, I don't have a lot of securities and will continue to be light until opportunity present itself or when volatility pick-up. This strategy can continue to make money as the market continue to grind higher but at the same time will help to limit losing positions on the downturn when volatility spike.

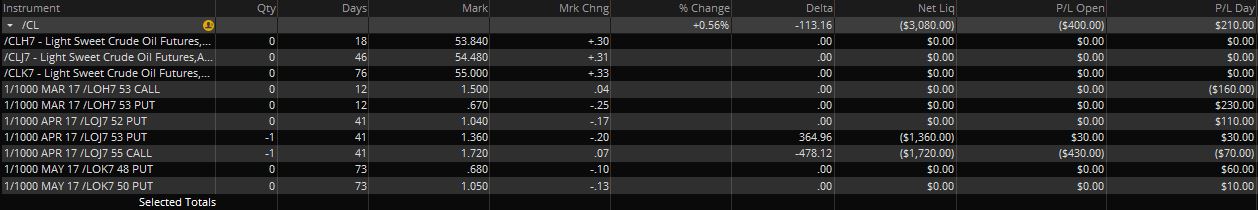

It was a great month as my profit continues to grind slowly upward along with the market. My trades continue to be light as I don't see a lot of opportunity and at the same time, I'm cautious as we're at market high. Today, my "net liq" value hits an all time high in my portfolio. Net liq is short for Net Liquidation value which is defined as the total cash value + commodities option value + stock value + securities option value + etc in your portfolio. With that in mind, I took the opportunity to protect my profit by reducing my exposure by taking profit on a number of underlying. Starting with my oil future contracts, I closed out the front month and next month's contracts with a nice profit. As you can see, I kept on rolling my put contracts upward to get to delta neutral. Every time I rolled up the contracts, I'm taking profit as well in this particular situation. Eventually (today), I closed out my straddles and strangles for either a break even or a small profit. I'm slightly delta short oil futures at the moment with a tight strangle. I'm long XOM which helps to counter the short in oil future a tiny bit. On my securities underlying, here are my outstanding positions. As I commented yesterday that I would look to add positions in Amazon after the earning shortfall overnight. An underlying equity I've been trading forever. My first trade after getting out of bed this morning was two long contracts in Amazon (selling into strength). Then I added a short call contract in Amazon as I drove my daughter to school. In the early morning, I rolled the short call contact down to get more premium. I wanted to get out of PCLN today but did not get a chance as volatility may creep up in the coming days due to upcoming earning. With GOOGL, I moved my long position up a bit to collect more premium or rather get closer to delta neutral. I got back into VXX as SPY went up (selling into strength). My overall position continues to be slightly delta short as beta weighted against the SPY. As you can see from my trading style, I like to take profit often. Small profit add up to big profit over time.

I managed to place a few trades today. If you've been following my trades, I've been a bit light in my trades. I'm usually very excited during earnings season but this time around I'm a bit cautious and have been on the sidelines as volatility is low and most of the stocks are at all time high. I was tempted but resisted from placing earnings play on Amazon, GoPro, and CMG. All three stocks dropped in after hours, especially GoPro (-12%+). I'll definitely look to scale into Amazon and will wait to buy into GoPro until next week. To summarize my trades today, I've added a long position in GOOGL, closed out of my PCLN strangle, then decided to continue shorting PCLN into next week. I'll likely look to close tomorrow or early next week for a profit, earning for PCLN is on 2/17th. After watching Under Armour for the past week, dropping almost every day, I finally decided to take a long position. ViaSat is a company that I love as I almost went to work for them at one point in my career. So instead of buying the stock outright, I'll sell a couple of contracts to collect premium with a break-even price of less than $59, not a very liquid underlying. I sold out of my VXX again to reduce my overall short delta. I bought into XOM to offset my slightly short position in future oil contracts.

|

Welcome!High probability option trading with Mr. 848Days! Archives

March 2017

|

- David's Memoirs

-

Portuguese

- PREFÁCIO por Russell Dorn

- CAPÍTULO 1: INTRODUÇÃO

- CAPÍTULO 2: ÁRVORE GENEALÓGICA

- CAPÍTULO 3: A ASCENSÃO DO KHMER VERMELHO

- CAPÍTULO 4: SOBREVIVENDO AO GENOCIDIO CAMBOJANO

- CAPÍTULO 5: UMA LONGA JORNADA PARA A AMERICA

- CAPÍTULO 6: ASSENTAMENTO E DE INTEGRAÇÃO NA SOCIEDADE

- CAPÍTULO 7: CARREIRA PROFISSIONAL

- CAPÍTULO 8: VIAGENS E AVENTURA

- CAPÍTULO 9: FAMILIA, BRASIL, PAIXÃO

- CAPÍTULO 10: O SONHO AMERICANO

- Contact

RSS Feed

RSS Feed